Steady and Strategic: Anchorage Market Snapshot

Anchorage Market Update – July 2025

Anchorage’s real estate market continues to defy national headlines. While major markets across the U.S. report rising inventory, slowed sales, and pricing pullbacks, our local market is showing resilience, measured growth, and tight supply. Despite higher rates and buyer hesitation elsewhere, Anchorage is quietly advancing, stable, active, and outperforming many national trends.

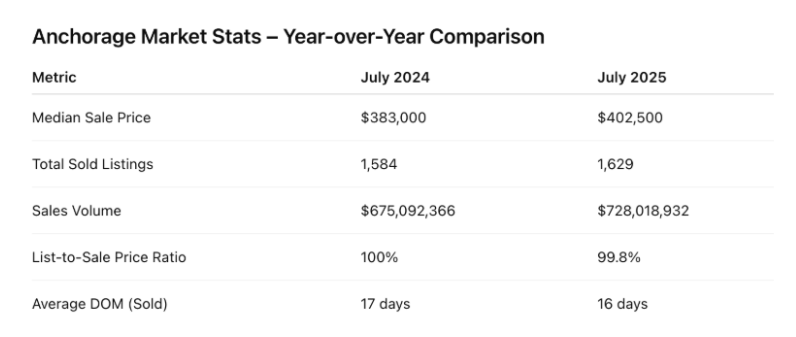

July data shows median residential sale prices in Anchorage reached $402,500, up from $383,000 last year, a healthy 5.1 percent increase year over year. The total number of sold listings climbed to 1,629 for the year to date, a 2.8 percent rise from the same period in 2024. Sales volume crossed $728 million, representing an impressive 7.8 percent growth. Median list-to-sale price ratios remain just under 100 percent, and the average home is going under contract in only 16 to 18 days.

Anchorage Market Snapshot: July 2024 vs. July 2025

|

|

This stands in contrast to national insights shared by experts like Ryan Serhant, who noted that U.S. inventory is at its highest point since 2019 and that sellers are increasingly needing to offer concessions to get deals done. While that trend is creeping into Anchorage, it’s happening slowly. Here, buyers are still acting quickly on well-priced homes, and we are not seeing the 30- to 60-day Days on Market (DOM) averages that have become common in other metros.

In fact, for July, Anchorage posted 420 active residential listings and 144 condos. Homes that are priced right continue to move swiftly, often in less than three weeks, and multiple-offer scenarios are still occurring in Southside, Abbott, and select East Anchorage zones. Properties that miss the mark on pricing or presentation, however, are increasingly experiencing longer days on the market. Several submarkets are now showing listings sitting 40 to 60 days or longer when overpriced.

To illustrate this trend, here’s a breakdown of how Anchorage’s key housing metrics compare to last year:

Despite national reporting of a market “cooldown,” Anchorage is still very much a seller’s market, but it’s a disciplined one. Overpricing leads to stagnation. Data from July confirms these findings with 51 withdrawn or cancelled listings and a growing number of homes returning to market after failed contracts, a signal that buyer scrutiny is rising.

For buyers, this market offers pockets of opportunity. Longer-sitting inventory is more negotiable, especially for VA-approved buyers and strong conventional borrowers. Anchorage condo inventory is also worth watching, with an average active DOM of 61 days and rising, which could allow room for discounted acquisitions or terms flexibility.

Nationally, firms like Compass reported transaction growth and market share gains in Q2, while economist Matthew Gardner expects only one interest rate cut before year-end due to lingering economic uncertainty. These national insights matter, but Anchorage continues to operate with its own tempo. Our lack of large-scale development, combined with healthy demand and a strong jobs base, means that pricing is holding steady, and momentum remains intact for sellers heading into the fall.

Looking ahead, the Anchorage market is positioned to remain strong through September and October. Seasonally, this is the final window for sellers to capitalize before the winter slowdown. For buyers, patience and leverage will go further on listings with more than 30 days of market time. For sellers, now is the time to price sharply, stage correctly, and list before snow flies. Pricing too high or waiting too long could result in sitting in Q1 with reduced momentum.

This is not a volatile or panicked market. It is a precise one. Anchorage is moving, just not blindly. Those who act strategically in this market, whether buying or selling, will continue to win.

If you’d like to discuss how these shifts impact your property’s value or explore opportunities in today’s market, reach out. As always, I’m here to help you make the most informed, strategic decisions possible in a fast-moving environment.

Posted by Matthew Lindsay on

Leave A Comment